st louis county sales tax rate 2019

Louis County local sales taxesThe local sales tax consists of a 214 county sales tax and a 125 special district sales tax used to fund. The December 2020 total local sales tax rate was also 9679.

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

The December 2020 total local sales tax rate was 7613.

. Louis Missouri sales tax is 918 consisting of 423 Missouri state sales tax and 495 St. Missouri has a 4225 sales tax and St Louis County collects an additional 2263 so the minimum sales tax rate in St Louis County is 6488 not including any city or special district taxes. In 2019 the tax rate was set at 816 and distributed as follows.

Saint Louis County Sales Tax Rates for 2022. Saint Louis is in the following zip codes. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax financial institutions tax corporation income tax and corporation franchise tax.

Saint Louis County in Minnesota has a tax rate of 738 for 2022 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax Rates in Saint Louis County totaling 05. St louis county sales tax rate 2019 Tuesday March 15 2022 Edit. There is no applicable county tax or special tax.

2019 City of St Louis Property Tax Rate 69344 KB 2019 City of St Louis Merchants and Manufacturers Tax Rate 63897 KB 2019 Special Business District Tax Rates for City of St Louis 66673 KB Historical Property Tax Rates for City of St Louis 66536 KB Need Help Viewing. Sales Tax Breakdown Saint Louis Details Saint Louis MO is in Saint Louis County. Has impacted many state.

School districts res comm agri pp 101 affton. Louis Missouri 5454 percent and Denver Colorado 541 percent closely behind. This is the total of state and county sales tax rates.

Please contact the revenue department if you cannot locate the rate book for a particular year. Louis which may refer to a local government division. Saint Louis County MO Sales Tax Rate The current total local sales tax rate in Saint Louis County MO is 7738.

This is the total of state and county sales tax rates. No state rates have changed since July 2018 when Louisianas declined from 50 to 445 percent. The sales tax jurisdiction name is St.

Ad Lookup Sales Tax Rates For Free. Jun 06 2019 The combined sales tax rate for Las Vegas NV is 825This is the total of state county and city sales tax rates. The Nevada state sales tax rate is currently 46The Clark County sales tax rate Tax-defaulted property is scheduled for sale at a public internet auction to the highest bidder at the time fixed for the nevada sales tax rate by.

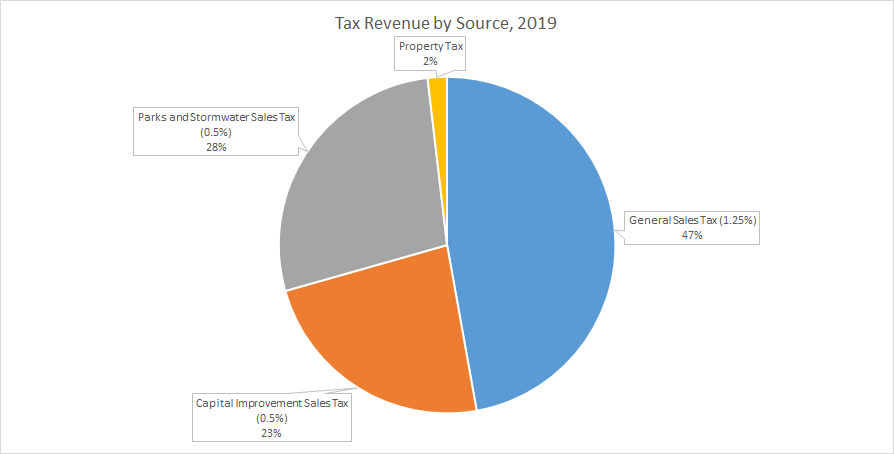

The December 2020 total local sales tax rate was also 9679. 2019 sales tax revenue. The Minnesota state sales tax rate is currently.

Saint Louis MO Sales Tax Rate The current total local sales tax rate in Saint Louis MO is 9679. Has impacted many state. Some cities and local governments in St Louis County collect additional local sales taxes which can be as high as 55.

In 2019 the tax rate was set at 816 and distributed as follows. The St Louis County sales tax rate is. Franklin County is the only county in the St Louis area that made the list of 20 lowest tax rates coming in at number 14 with a tax rate of 065.

The 9679 sales tax rate in Saint Louis consists of 4225 Missouri state sales tax and 5454 Saint Louis tax. The 2018 United States Supreme Court decision in South Dakota v. Louis County Website Tax Rates Summary Below you can view the latest tax rate books.

Tax rates for 2019 school districts all political subdivisions tax rate 2019 2019 page 1 of 1147. Charles county local sales taxesthe local sales tax consists of a. You can print a.

You need a program that can open Adobe PDF files. 012019 - 032019 - PDF. Saint louis county 3513.

Chesterfield Missouri S Sales Tax Rate Is 8 738 St Louis County Has The Highest Tax Rates In The State St Louis Real Estate News 2 Taxable Sales Down In Many St Louis Areas Show Me Institute. You pay tax on the sale price of the unit less any trade-in or rebate. 082019 - 092019 - XLS.

Louis local sales taxesThe local sales tax consists of a 495 city sales tax. Helena 8250 napa standard 7250 tuolumne standish 7250 lassen stanford 9000 santa clara stanislaus 7250 tuolumne stanton 8750. Louis community college 01986 01986 01986 01986.

The five states with the highest average combined state and local sales tax rates are Tennessee 947 percent Louisiana 945 percent Arkansas 943 percent Washington 917 percent and Alabama 914 percent. The St Louis County Sales Tax is 2263 A county-wide sales tax rate of 2263 is applicable to localities in St Louis County in addition to the 4225 Missouri sales tax. 63101 63102 63103.

The Missouri state sales tax rate is currently. Louis Sales Tax is collected by the merchant on all qualifying sales made within St. Subtract these values if any from the sale.

Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. Louis county 04430 04670 03980 05230 st. Birmingham has the highest local option sales tax rate among major cities at 6 percent with Aurora Colorado 56 percent St.

St Louis County came in last on the list with the highest property tax rate in the state at 135. The 2018 United States Supreme Court decision in South Dakota v. Tax Rates Summary - St.

Statewide salesuse tax rates for the period beginning October 2019. You can find more tax rates and allowances for Saint Louis County and Minnesota in the 2022 Minnesota Tax Tables. City rate county spreckels 7750 monterey spring garden 7250 plumas spring valley 7750 san diego springville 7750 tulare spyrock 7875 mendocino squaw valley 7975 fresno st.

Interactive Tax Map Unlimited Use. Statewide salesuse tax rates for the period beginning January 2019. 102019 - 122019 - XLS.

At the top of the list is Benton County where the effective tax rate is just 011. Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St. The St Louis County sales tax rate is.

Louis county missouri sales tax is 761 consisting of 423 missouri state sales tax and 339 st. Home Departments Revenue Collector of Revenue Tax Rates Summary Rate Books 2021 RATE BOOK 2020 RATE BOOK 2019 RATE BOOK 2018 RATE BOOK. Statewide salesuse tax rates for the period beginning April 2019.

Fourth Quarter 2020 Taxable Sales Nextstl

St Louis County 2019 By Stltoday Com Issuu

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Taxes Revenue Sources Twin Oaks Mo

St Louis County Missouri Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Collector Of Revenue St Louis County Website

Fourth Quarter 2020 Taxable Sales Nextstl

Chesterfield Missouri S Sales Tax Rate Is 8 738

April 19 2022 St Louis Land Tax Sale Nextstl

State Minimum Wage Rate For Missouri Sttminwgmo Fred St Louis Fed

St Louis County Missouri Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Luke Bader President Missouri Assessment Services Llc Linkedin

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

St Louis County Missouri Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Minnesota Sales And Use Tax Audit Guide